DATA CLEAN ROOM FOR FINANCIAL SERVICES

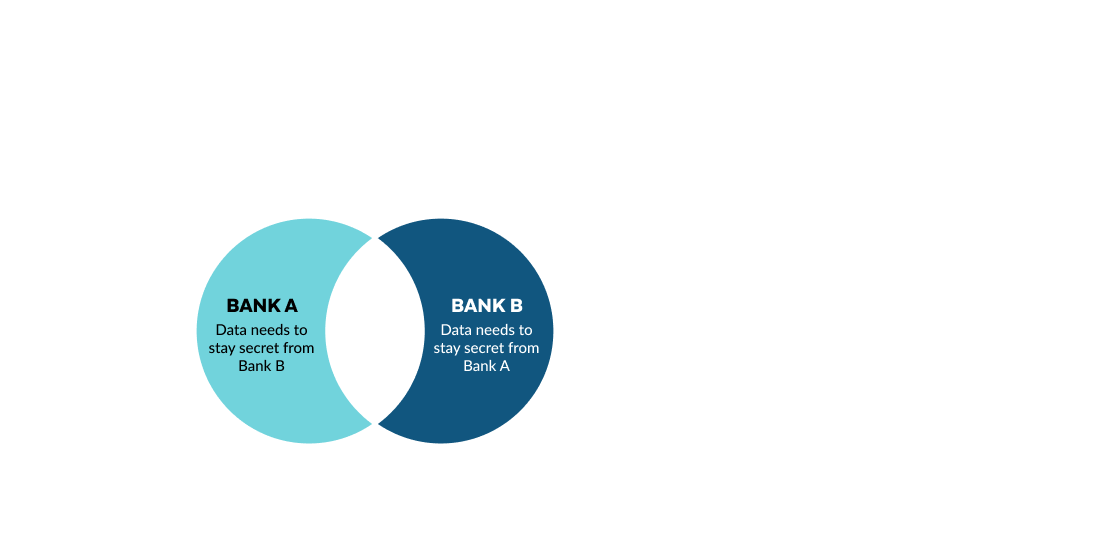

Access, join, and query sensitive data across multiple banks or between business lines of a single company while enabling compliance with data privacy laws.

DATA CLEAN ROOM USE CASES

Fraud Detection

Securely access and match customer information with third-party transactions, payment, or geospatial data to detect fraudulent transactions or claims.

Customer 360

Provide customers with an integrated digital experience by connecting and collaborating with other banking and fintech partners.

Targeted Marketing

Measure marketing performance and acquire new customers by securely sharing first-party data with marketing and media activation partners.

Why Snowflake?

Secure data sharing technology

Access, match, and collaborate using customer data without revealing PII or compromising privacy.

Highest standards of governance

Secure and governed access to live, ready-to-query data that remains in your environment

Enable Data Science

Validate query requests and incorporate ML to power use cases like customer 360 and fraud detection.